Croatian savers put away an average of HRK 452 a month

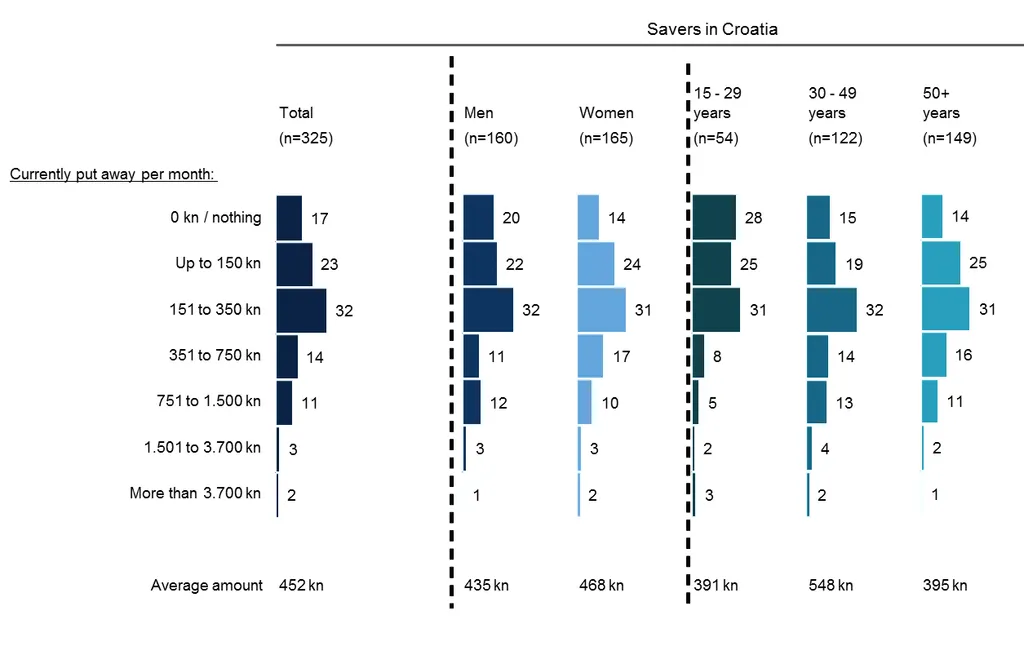

Zagreb, 20 October 2015 – According to results of a survey with 500 participants on saving habits in Croatia, conducted in August 2015 by the IMAS agency and ordered by Erste Group, almost 80% of Croatian citizens are aware of the importance of saving, and they put away an average HRK 452 a month. Majority of those citizens, 90% of them, list the need to form a financial back-up for emergency situations as the main purpose of saving, followed by the need for smaller or larger acquisitions, i.e. renovations (29%) and saving for the “old age” (24%). Although the citizens aged from 30 to 49 save the highest average amounts, HRK 548 a month, only 27% of them are satisfied with the amounts they save. The younger ones, aged between 15 and 29, save an average of HRK 391 a month, and older than 50 save HRK 395, and more than one third of them are satisfied with the amounts saved.

If we compare the Central and Eastern European countries, i.e. the amounts put away by people in these countries for the purposes of saving, Austria is at the top position. Austrians save an average of EUR 201, followed by Slovaks with the average savings of EUR 94 and Czechs with EUR 76. Croatians, who save an average of EUR 60 a month, are followed by Hungarians (EUR 47), Romanians (EUR 41) and Serbs (EUR 35). The average savings increased compared to last year in all countries except in Slovakia and Hungary (-2 euro); Austrians are once again the savings champions with the average increase of savings by EUR 13.

Less and less citizens keep their savings at home

The largest number of people, 41% of them, opts for the classical savings accounts, followed by life insurance, housing saving, investment funds and private pension savings. Men are in general more prone to classical savings accounts compared to women, while women prefer housing saving and life insurance. In addition, the survey shows that the percent of citizens who keep their savings at home continuously decreases. This year, their share is 17%, compared to last year’s 25% and 21% in 2013.

The 10% more, 10% less effect – to save or to spend?

Asked what would they do if they had the additional HRK 4,000 at their disposal at the moment, half of the respondents (48%) would put it in their transaction accounts, and a bit more than the third of them (36%) in their savings books or savings accounts. But, if their monthly budget increased by 10% from this moment onwards, more than half of the respondents (54%) would put that amount in their savings

accounts. On the other hand, if their available budget decreased by 10%, the half of the respondents (51%) would both spend and save less, while the other half would either save less or spend less.

Who is the most responsible for the level of financial literacy of the citizens?

Asked whether they thought if they had enough knowledge about financial topics and banking products, as much as 32% women said they were not satisfied with their knowledge. The men were somewhat less critical, so 20% of them said they did not have enough knowledge about those topics. In addition, the respondents believe that the responsibility for the financial literacy is equally distributed among schools (26%), government and public institutions (23%), family (21%) and banks (19%). Women believe the family is most responsible (25%), while men consider the government and public institutions the most responsible (28%).