Citizens' savings are lower by HRK 20 on average compared to last year

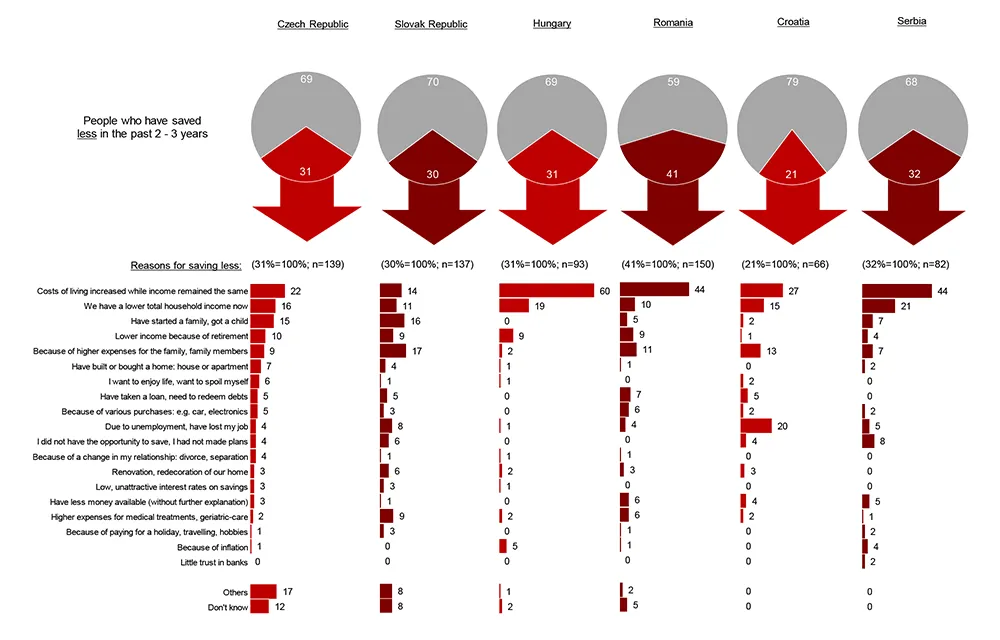

Zagreb, 27 October 2016 – A survey of savings habits in Croatia, which was commissioned by Erste Group and conducted by IMAS agency in September 2016 on a sample of 500 respondents, showed that nearly 80% of Croatian citizens are aware of the importance of saving money and on average save HRK 432 a month, which is HRK 20 less compared to last year. Just over 20% of respondents said that they have been generally saving less in the past two or three years, for various reasons. Most often cited reasons included higher costs of living while income remained the same (27%), unemployment, i.e., loss of job (20%), and lower total household income (15%).

Zagreb, 27 October 2016 – A survey of savings habits in Croatia, which was commissioned by Erste Group and conducted by IMAS agency in September 2016 on a sample of 500 respondents, showed that nearly 80% of Croatian citizens are aware of the importance of saving money and on average save HRK 432 a month, which is HRK 20 less compared to last year. Just over 20% of respondents said that they have been generally saving less in the past two or three years, for various reasons. Most often cited reasons included higher costs of living while income remained the same (27%), unemployment, i.e., loss of job (20%), and lower total household income (15%).

But compared to Central and Eastern European countries, Croatia had the lowest percentage of respondents saying that they save less than before. Nearly one in two depositors in Romania and one in three in Slovakia, Czech Republic, Hungary and Serbia are saving less than two or three years ago. The most often cited reason for this are higher costs of living while income remained the same, particularly in Hungary (60%), Romania (44%) and Serbia (44%).

Asked whether they changed anything with regard to their savings habits in the context of currently low interest rates on deposits, 30% said they did not, 29% said that, due to low interest rates on savings, they give surplus money to children and family, and 24% said they invest money in real estate. 15% of respondents said they keep money in a current account or simply spend more.

Increasingly fewer citizens keep savings at home

A total of 45% of citizens have classic savings accounts, which represents a slight increase compared to the previous year. Next most popular savings types are housing savings, life insurance and voluntary pension savings. Compared to last year, the number of respondents who keep their savings in the form of cash, at home or in a safe, fell from 17% to 12%, and has been declining continuously during the past three years.

Similarly to Croatia, classic savings accounts are also highly represented in other Central and Eastern European countries: nearly 80% of Austrians, 60% of Slovakians and 25% of Hungarians have a classic savings account. Czech citizens most prefer pension insurance subsidized by the state (48%), while Romanians (23%) and Serbians (9%) prefer life insurance.

Who to ask for advice on how to save or invest money?

Asked whether they thought they were sufficiently informed about financial topics and banking products, 34% of women and 25% of men said they were not satisfied with the level of their knowledge. When it comes to advice on how to save or invest money, 34% of respondents said they would ask their family and friends, 30% said they would ask their personal banker/advisor or ask for advice at a bank, while 35% of respondents said they do not need additional advice.