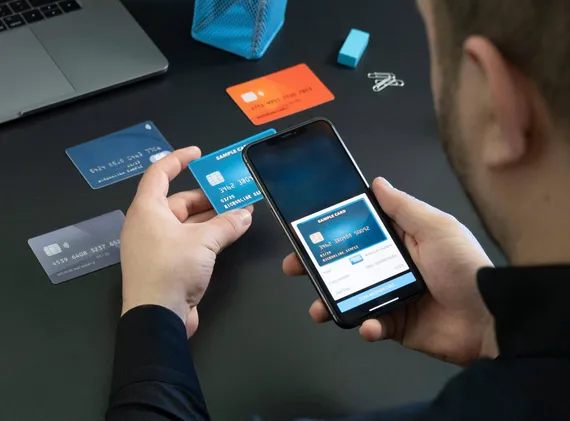

Erste Bank’s Keks Pay mobile app offers the bank’s users a quick and easy way to scan credit and debit cards. This is a novelty on the Croatian market, developed by the Microblink company. It enables users to enter card information much quicker, by using their smartphone camera instead of doing it by hand. Information scanning takes place in the device itself. No data is stored or processed on a server, which guarantees a high level of security.

Keks Pay enables users to send and receive money quickly and securely, without any fees. It is the first banking service on the Croatian market which can be used by all users, regardless of their banks. Just six months after launch, Keks Pay has over 42,000 users, and more than 120,000 transactions have been initiated, averaging at around HRK 45. 73 percent of the app’s users are clients of another bank, while the remaining 27 percent are clients of Erste Bank.

“We have been working with Microblink for many years now, and our cooperation also resulted in a big innovation on the Croatian market, called “Slikaj i Plati”, which we offered to our mBanking users in 2011. Taking into account that simplicity of use was one of our priorities during the development of the Keks Pay app, from the on-boarding process to the transactions themselves, we wanted to give our users the option of not typing in the information from their cards. Even though we had solutions with similar options, Microblink’s solution was the one we were completely satisfied with, because it is extremely fast and secure. It also supports a wide spectrum of debit and credit cards”, said Dejan Donev, Head of Erste Bank’s Digital Transformation Team.

“We are proud of developing our own computer vision technology based on artificial intelligence, which changes the ways we have been using our cellphones, cameras, and apps. After years of cooperation, we are glad that Erste Bank and Keks Pay are the first ones in Croatia that have implemented our BlinkCard system for entering card information quicker and easier. We pay close attention to creating a state-of-the-art user experience, because our greatest pleasure is to see satisfied and impressed end-users” , said Izet Ždralović, Microblink’s co-founder and Management Board member.

Microblink is a tech company, which develops B2B software solutions based on computer vision technology. Microblinks products are used mostly in the banking and financial industries, but also in telecommunications, the airline and hotel industry, and many others. Microblink is best known in Croatia for its “Slikaj i Plati” service, which scans slips for payment of bills.